Azure Certification from Microsoft – Benefits and Learning Path

The recent developments in large-scale cloud services have changed the modes of IT service delivery to a large extent. Well, known cloud platforms from the world’s leading providers like Microsoft, Google, and Amazon are constantly evolving, which has a big impact on the IT industry as well as the IT professionals.

When it comes to information technology businesses or other sectors dependent on IT, any decision to adopt technology or upgrade it has an immediate impact on the performance, cost, security, delivery, and customer satisfaction. High level of decision making, design, and implementation, and administration skills are required to manage these sophisticated IT-centric industries. The frequent and fast changes in technologies are creating skill gaps in the IT marketplace, which is the major problem enterprises are finding while tapping the opportunities.

Lately, with a large number of organizations across the globe adopting cloud technologies, there is a huge demand for skilled professionals in it. One can enjoy high salaries and a wide range of opportunities in cloud computing if they become experts to manage the fast-changing cloud computing environments. For the cloud career aspirants, MS Azure certification is one great way to achieve this necessary skill-set.

About MS Azure

As admired by the industry, one specific skill which recruiters are looking for while hunting for cloud computing specialists is Azure Certification from Microsoft. Owing to the growth in the cloud sector, job opportunities for MS Azure certified professionals had increased drastically over the last couple of years.

- As per a press release by Microsoft, nearly 1000 customers are signing up for Azure suite daily, which can be projected as about 3,65,000 organizations adopting the technology each year.

- Considering the Fortune 500 companies, about 57% of them have implemented Azure.

- The cloud revenue of Microsoft had increased by 104%.

- UK government had given an official accreditation to Microsoft Azure, and US government also backed it for government offering.

All the points towards the future potential of Azure to create a huge number of job opportunities in the coming years. It is easy to learn and adapt, and also a highly efficient tool to handle the traditional tasks like designing, deployment, and management as well as to meet the needs of the future big data environments.

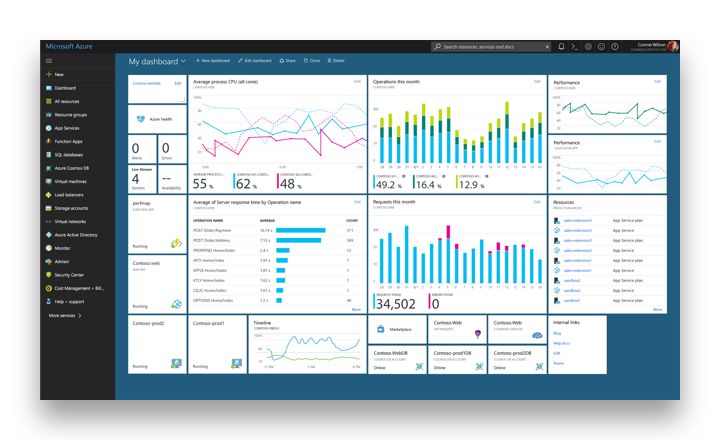

Azure in business IT

As we have seen, Azure is a cloud computing solution and to be more precise, and it offers an advanced cloud platform which helps the organizations to build, deploy, and operate managed services wherever they want to. The major competitors of Azure are AWS (Amazon Web Services), and Google Cloud.

There are two handy models of Azure services as:

- Infrastructure as a service (IaaS), in which you let the provider (Microsoft) handle your networking and computing needs.

- Platform as a service (PaaS), where you add the cloud capabilities as a platform only to your existing network and manage it your own.

With Azure, Microsoft provides the clients with access to the service directory which is constantly building. This now includes:

- Virtual machines – You can use the pre-existing templates or create your machine images to prepare Windows or Linux virtual machines and host any apps and services in these virtual machines.

- Application services – Deploy new enterprise applications and gain instant and scalable access to it with minimal risk of downtime or data loss.

- Active directory – Better manage the authentication, group policy, and security settings, etc., remotely.

- Storage – Secure your critical business data with the solid infrastructure by Microsoft, all at an affordable cost.

- SQL DB – Enjoy unlimited SQL relational database from Microsoft without the need for any on-premise software or hardware.

Why use Azure?

The primary benefits of hosting critical business solutions using Azure as SAP Business One include:

1. High flexibility

In fast-changing market conditions, you may experience a positive spike in your favor with a demand for more efficient technology solutions at any time. In such situations, Azure has it all covered well. You may design and launch innovative services at any time in lightning speed with the scope of scaling up storage and processing capabilities instantly.

2. Save cost

There is a very limited upfront cost for migration, and when it comes to maintaining hardware and that of energy consumption, you will reduce the overall costs. As the cloud providers offer security administration, the security costs are also covered. With enterprise-grade cloud services, you need to pay only for the availed resources, which can be scaled up or down at any point.

3. Services to meet any needs

Azure offers a huge number of à la carte services. You may search the Azure service list first when you have the need of any service or business app next time. Even on thinking of a customized app, there is no need to start from the very scratch as many of the apps can be integrated into the already existing framework and custom tailor meet specific needs.

Apart from the above, Azure also features fully managed services, quick disaster management, remote access management, etc., which makes it a highly flexible and user-friendly platform for business administrators. As the adoption rate of Azure is going up, the industry requires more skilled and knowledgeable Azure experts to handle the tasks at various types of IT settings.

Azure training

For beginners, Microsoft Official Curriculum could be a good option to start with the basics of Azure. Microsoft directly offers some support to IT professionals with some eBooks etc. through the MVA (Microsoft Virtual Academy). Over time, Azure certification had undergone several improvements too. Now, the certification path of MS Azure is more modular with the need to develop IT infrastructure management skills, especially Windows Server. Some exams aimed at Azure certifications are:

- Exam 70-533 – Implementing Microsoft Azure Infrastructure Solutions

- Exam 70-532 – Developing Microsoft Azure Solutions

- Exam 70-534 – Architecting Microsoft Azure Solutions

You will also find many other certification exams closely related to it like Exam 70-473, Exam 70-475, Exam 70-744, Exam 70-413, Exam 70-414, Exam 70-246, Exam 70-247 related to public and private cloud administration and Windows server infrastructure administration, etc. to hone your skills.

Source –

Source –  Source –

Source –  Source –

Source –