How Can SEO Professionals Do Business in a Sluggish Economy?

The SEO industry has resumed back its course, after the recent Google update! Now the SEO vertical is booming, and there are ample business opportunities that SEO professionals can grab and leverage. But there’s no guarantee, that’s how everything is going to be forever. The economy can change anytime and become sluggish. It can hamper business, and the SEO professionals might not have the required strategy to work their way out.

Economic downswings are inevitable! It occurs when you least expect them. Sometimes, SEO experts can see vital signs. An economic downswing will impact an SEO professional’s capacity to maintain revenue. But when you work out way well enough, you can even thrive during a slow economy. Today, you need to join hands with an ace SEO agency or service provider to stay guided and well advised. It will help your in-house SEO staff. To know more about this, you can check out Social Market Way.

You can use the following steps to ensure positive results in a slow economy.

Maximize the marketing activity

As the economy slows down, usually people put a pause on the marketing activities. They minimize the costs every way possible. However, this strategy can result in a downfall. It is easy to understand why this can happen! If your marketing activity gets minimized, you lose out on valuable exposure as well. Less exposure means less revenue. It’s a negative downward spiral, and you should omit this.

A slow economy is a great time to review all the marketing strategies and recognize ineffective tactics, channels, and campaigns. You can even delete these. However, that should be an ongoing practice. Anything that you save will eventually get invested in some form or the other in your business. The added benefit is the fact that when the economy is not at its best, all the other market players and competitors will reduce their marketing initiative as well. And it will give you increased advertising scopes. And at times, you can get this done at a decreased price that you have access to.

SEO professionals need to take a leap of faith and maximize their marketing. It might seem counterproductive for a while, but then SEO professionals will soon see the difference.

Get involved with direct sales

Most SEO professionals aren’t very fond of the word “sale.” And that is the reason why very few place emphases on networking. And even a lesser number gets some business procured. However, the good news here is that it is familiar with all or most of your market-players. So, do you not prefer the idea of being out in public and get involved in direct sales? If yes, then you need to reconsider a few things. It is essential to move away from this feeling if you wish to make the most of a slugging economy.

Sales don’t necessarily mean high-pressure, sales-y tactics. It doesn’t indicate making a client uncomfortable with a sales proposal, forcing them to make a purchase. It is more to do with strategic initiatives. The best way to go about it is to choose a specific section of high-end prospects and start by connecting with them through a phone call, email as well as other face-to-face interactions.

The ultimate objective is to bag a client. The aim is to create a bond. It could mean you make a phone call or send a business proposal. It will help you to introduce your brand. And after that, you can start to qualify for the sales process slightly more. Take time out to understand the business requirements and pitch your product through a sales proposal mail. Here you can make use of the required keywords, to attract your client’s attention. For this, you need to do some extra background and research work. You should have this entire strategy planned. Else, there might be careless mistakes, which can cost you more during an economic downswing.

Make the most referrals

Most SEO professionals get a massive chunk of their work through referrals. And when the time comes, it is always best to connect with the references and ask for further recommendation. Make sure that you are clear about your business plans with the referrals. That will help them assist you better. You can send out a mail to the ones present in your referral list. Also, if there are a few names, that you feel you should get connected individually, go ahead and do that.

Your referrals might not have immediate work for you! The idea is to wait and get back when you deem fit. Sometimes, getting work means being active in your referral follow-up. Make sure you manage your referral list effectively even when the economy is back to a good shape.

Complete what you’ve undertaken

SEO professionals are never entirely out of a job! Even when the economy is sluggish, there’s some work or the other finish. It could be managing a keyword list, preparing cluster keywords, competitor analysis, and the like. You might have to develop a PPC strategy for a client that they will use once the economy bounces back. So, while you leverage your referral list and get engaged in direct sales, make sure that you don’t ignore what you have at hand.

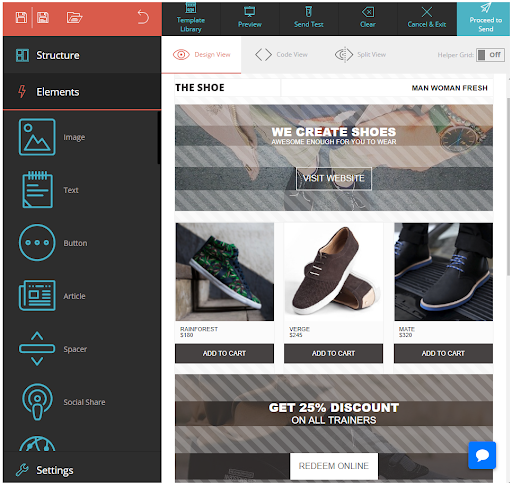

Carry on with the SEO plan that you had proposed your client, for whom you are already working. But consider the current economic condition and make the necessary changes. For instance, it makes sense to reduce the SEO content and blog frequency when there’s an economic downturn. You might want to focus only those keywords of which you are certain. Experimenting with long-tail keywords and keyword cluster can happen later. Try and rephrase the old web content by adding a new tweak. It is a perfect time to make these critical changes.

These are some of how SEO professionals can still stay in business during a slow economy. It helps them to respond according to the current situations and also ensure that they don’t go out of business. You can even think of other strategies as they survive through the slow economy phase.